Featured

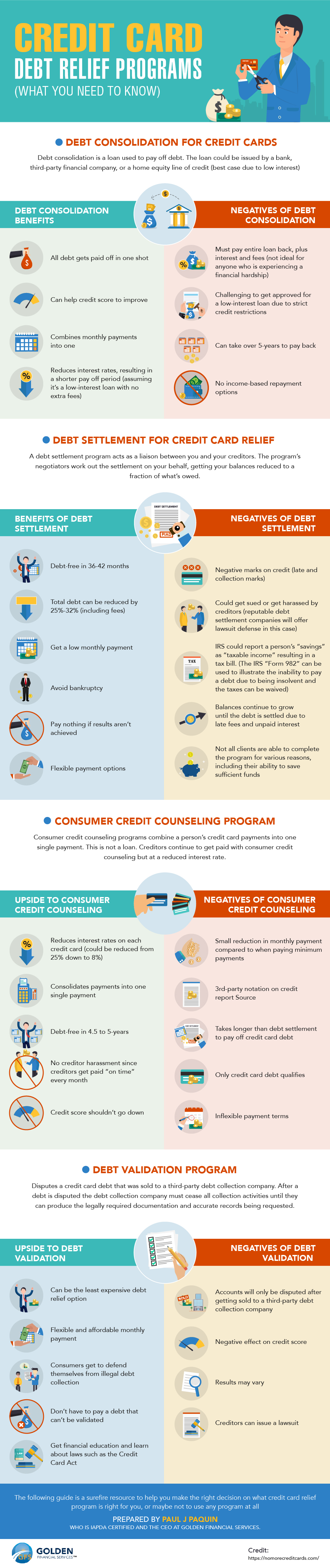

Whichever your scenario is, take into consideration talking to a qualified credit report therapist, a personal bankruptcy lawyer, or a qualified financial obligation consultant prior to moving on. They can assist you obtain a full understanding of your financial resources and options so you're better prepared to make decisions. Another variable that affects your options is the sort of debt you have.

Kevin Briggs was a successful property manager with a six-figure income, but after a year of pandemic obstacles, he discovered himself in 2021 with $45,000 in credit scores card financial debt."Less than three years later on, Briggs had actually eliminated his credit rating card debt, many thanks to that rescue a new not-for-profit debt relief program from InCharge Debt Solutions called "Credit report Card Financial Debt Mercy."Credit Report Card Financial debt Forgiveness, also known as the Less Than Complete Balance program, is financial debt relief for people that have not been able to make credit score card repayments for 6 months and lenders have actually charged off their accounts, or are about to.

The catch is that nonprofit Bank card Financial obligation Mercy isn't for every person. To qualify, you must not have made a payment on your credit score card account, or accounts, for 120-180 days. In enhancement, not all financial institutions get involved, and it's only provided by a few nonprofit credit report therapy companies. InCharge Debt Solutions is one of them.

The Credit Scores Card Forgiveness Program is for individuals who are so much behind on debt card settlements that they are in serious economic trouble, possibly dealing with personal bankruptcy, and don't have the earnings to capture up."The program is especially developed to aid customers whose accounts have actually been billed off," Mostafa Imakhchachen, consumer care professional at InCharge Financial obligation Solutions, said.

All about Questions You Should Ask Any Credit Counseling Services : APFSC Help for Debt Management Provider

Financial institutions who take part have agreed with the nonprofit credit counseling firm to accept 50%-60% of what is owed in taken care of regular monthly repayments over 36 months. The set settlements imply you know exactly just how much you'll pay over the repayment duration. No rate of interest is billed on the equilibriums throughout the reward period, so the settlements and amount owed don't alter.

Latest Posts

The Buzz on Warning Signs While Researching a How Specialty Counselors Help Clients Facing Legal Separation or Child Support Changes Provider

Our Knowing Your Protections Concerning Bankruptcy Proceedings PDFs

Is It Worthwhile to Invest in Professional Specialty Counseling Services : APFSC Tailored Financial Support for Dummies

More

Latest Posts

Our Knowing Your Protections Concerning Bankruptcy Proceedings PDFs

Is It Worthwhile to Invest in Professional Specialty Counseling Services : APFSC Tailored Financial Support for Dummies